Bridging loan how much can i borrow

In some situations it is possible to borrow 100 of a propertys value with a bridging loan. From there it can work out based on the loan principal plus the interest what the total figure it is you need to pay over the loan term.

Calculator Bridging Loan Ifg Home Loans

19 - 39 per month.

. Many property developer clients use bridging finance to fund their development projects. As long as the LTV is 75 or below based on the combined value of properties being used as security then 100 bridging is. We will ensure we give you a high quality content that will give you a good grade.

You must be refinancing a minimum loan amount of 250000 with a loan-to-value ratio up to 80. Parents can gift 3000 per year without paying tax on it and any unused allowance from previous years can usually be rolled on. Can I borrow 100 LTV with a bridging loan.

Borrow between 50000 to 10 million repaid over 3 to 24 months. The ultimate resource for UK property investors Property Geek. But this means theres a limit to how much you can borrow usually up to 25000.

There is a limit of one cashback offer per primary applicant within a 12 month period. Inheritance tax may be required over this amount though. How much can I borrow and how much deposit will I need.

If this is also happening to you you can message us at course help online. But theres no fixed upper limit. Terms of 3 - 12 months.

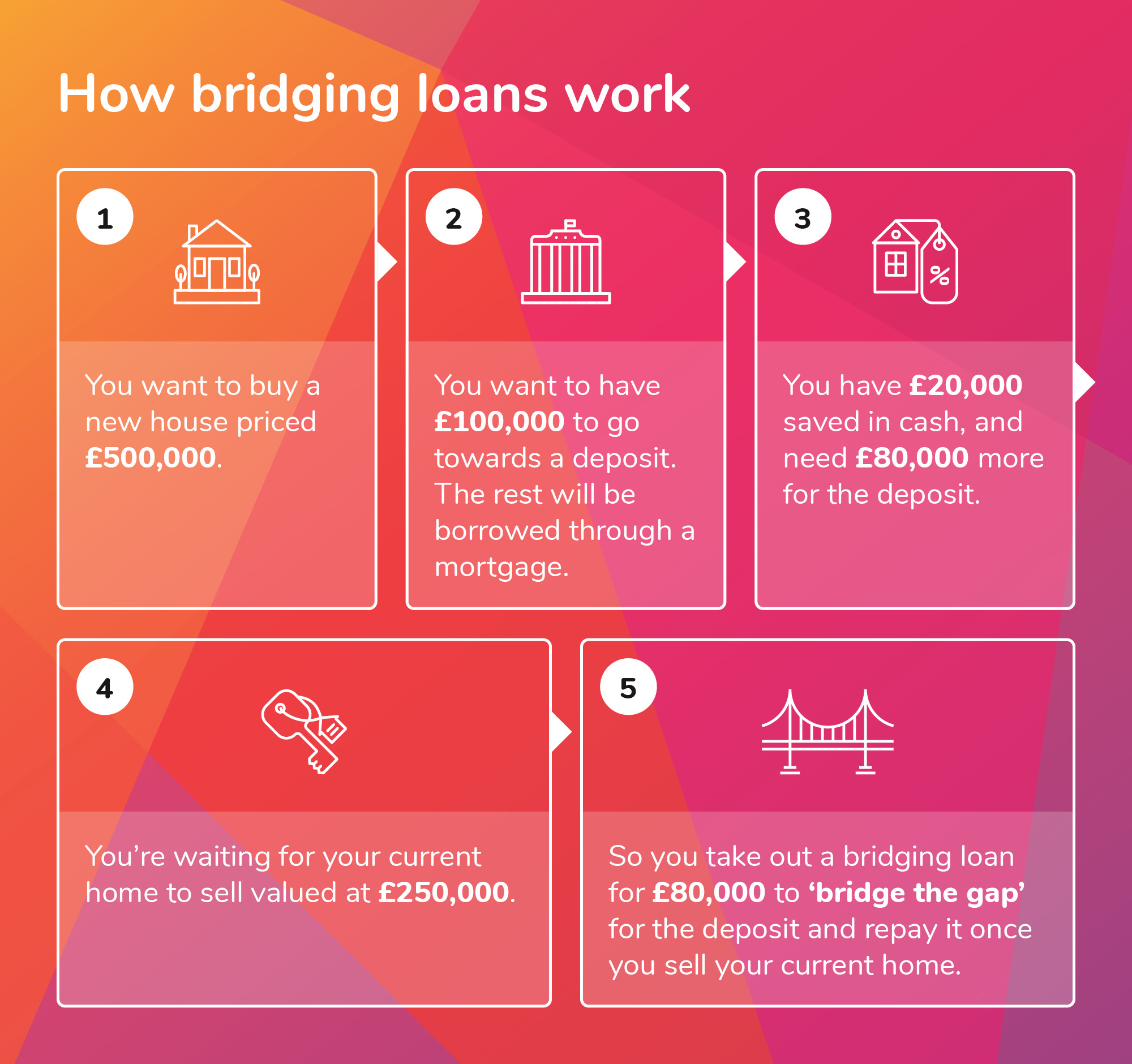

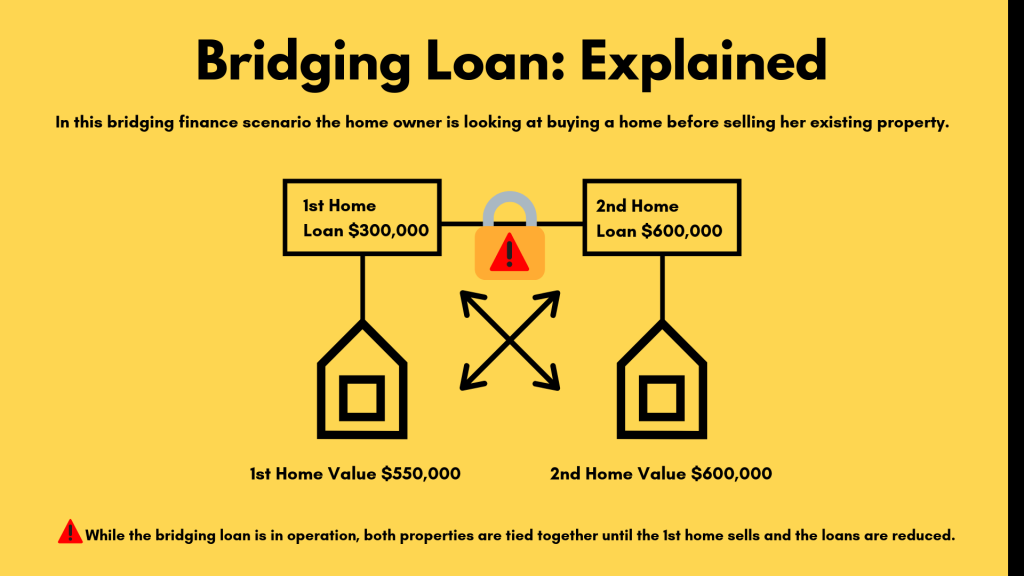

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. A fixed rate means the interest rate wont change throughout the term of the loan so each monthly payment will stay the same. Because the bridging loan is secured against the property interest rates are much lower than a standard loan would charge and you can borrow much more at least up to the value of the property if needed.

The typical smallest amount you can borrow is 25000. Usable income 70k this will be the figure thats multiplied to calculate your loan You can use our debt-to-income calculator below to work out how your outgoings could impact your maximum. Online personal loan calculators let you know how much money you can borrow from lenders.

If you have a high salary but also very high outgoings it could impact how much you can borrow. But youll usually only be able to borrow a maximum loan-to-value ratio LTV of 75 of the value of your property. A Complete Guide.

This is because you can secure a bridging loan across more than one property. Compare bridging loans today and find the right deal for you. The amount you can get will vary between lenders.

The longer it takes you to sell your current home the longer youll be charged interest on the bridging finance. Bankfinancial institutional stationery logoABN Account number. Account nameownership of debt.

A bridging loan is used for short-term borrowing often used to secure a property. How much can you borrow with a bridging loan. Whenever students face academic hardships they tend to run to online essay help companies.

You can determine the lowest by comparing several loans from different money lenders or banks. Bridging Loan Finance Interest Rates. Borrow 5000 - 500000.

We can lend you up to 75 of your propertys value so youll need at least 25 as a deposit. Always borrow a bridging loan with the lowest interest rate available. Skip to content.

The maximum loan-to-value ratio we can. Bridge loan interest rates depend on your creditworthiness and the size of the loan but generally range from the prime ratecurrently 325to 85 or 105. What mortgage can I get for 500 a month in the UK.

A second charge bridging loan could be the ideal solution for those who already have a mortgage secured against their property but require further funds. These are set by the lenders and are often a percentage of the new houses sale price. In cash terms bridging loan providers might lend anything between 25000 and over 25m.

Discover how Together can help with our bridge finance products. More established businesses can also use it as a bridging loan alternative to pay an urgent VAT or tax bill. Licensed moneylenders offer a similar rate to personal loans 1-4.

You may be better off asking for an extended. MT Finance is an award-winning Bridging Finance lender in London. Bridging loan to flip a property.

The difference between regulated and unregulated bridging loans. Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. For example if you borrowed 500000 and your total interest charge was 350000 over 30 years then the total amount payable would be 850000.

There are some exceptions and your lender will let you know if this is the case. A Bridging Loan is generally an Interest Only loan for the 12-month period. Our buy to let mortgage calculator gives you essential information on interest rates LTV monthly payments how much you can borrow and more.

Expected rental yield for the property must be enough to cover at least 145 of a notional 55 interest rate on the loan. Just like mortgages bridging loan rates can be fixed or variable. For example if a parent hadnt gifted any money for the past five years they could give 15000 towards a deposit tax-free.

With a variable rate bridging loan the interest rate can change which will push your payments up or down. The variable rates usually set by the lender. Unsecured secured options.

The level of ICR can depend on whether you. With a fixed rate home loan you can take out your bridging loan alongside your current loan and keep your repayments for each loan separate. Bridging Short Term Finance.

The money from selling your old house goes straight to paying off the bridging loan. With Fleximize you can apply to borrow between 5000 and 500000 depending on your monthly revenue. If you dont sell your home in the agreed period we may get involved to sell the property.

If youre on a variable rate home loan you could either keep your bridging loan separate or refinance your existing home loan into the bridging loan. A bridging loan can help you bridge the gap if you want to buy a new home before selling your current one. Home loan statements are generally not required.

How much can I borrow. Decisions in 24 hours. We can handle your term paper dissertation a research proposal or an essay on any topic.

How to check how much I can borrow using a personal loan calculator. So weve put together some guides on commercial bridging finance development loans and even a bridging loan calculator so you can weigh up your finances before you apply. MoneyMe offers free easy-to-use large and small loan calculators you can.

Where home loan statements are required they must show the following. Borrow up to 80 of the new property value.

Bridging Loans Commercial Bridge Finance For Business

What Is A Bridging Loan The Benefits Challenges Property Secrets

Is A Bridge Loan Right For You Forbes Advisor

Bridging Loans How Bridging Loans Work Mortgage Choice

Ultimate Guide To Hmo Bridging Finance 2020 Hmohub

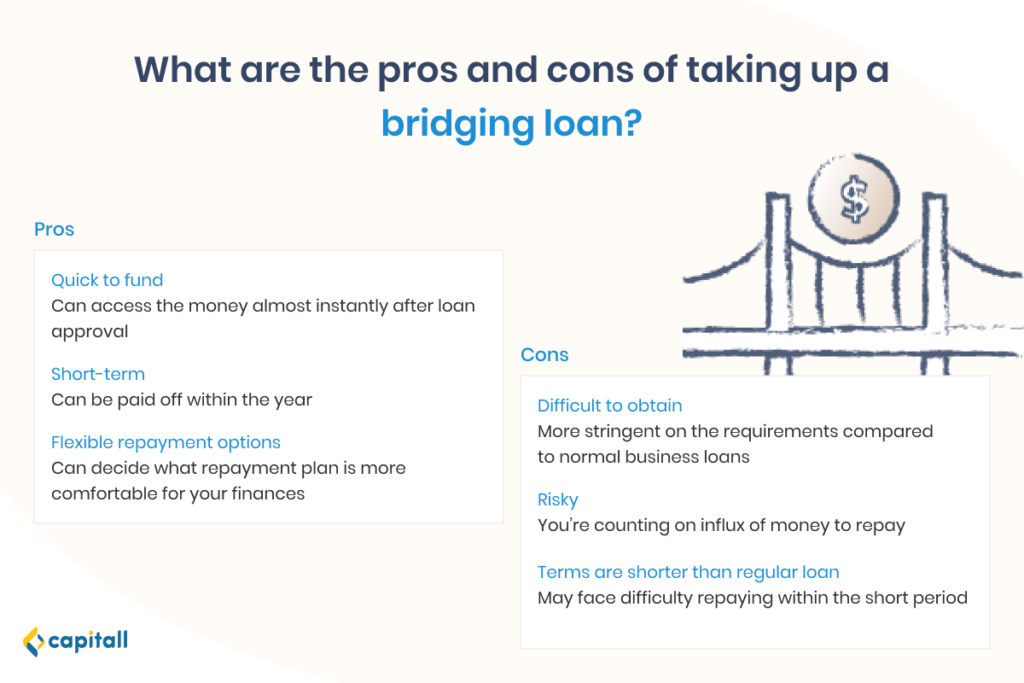

Pros And Cons Of Getting A Bridging Loan For Your Business Capitall

The Bridging Loan What It Is And What It Covers Mortgageinsides

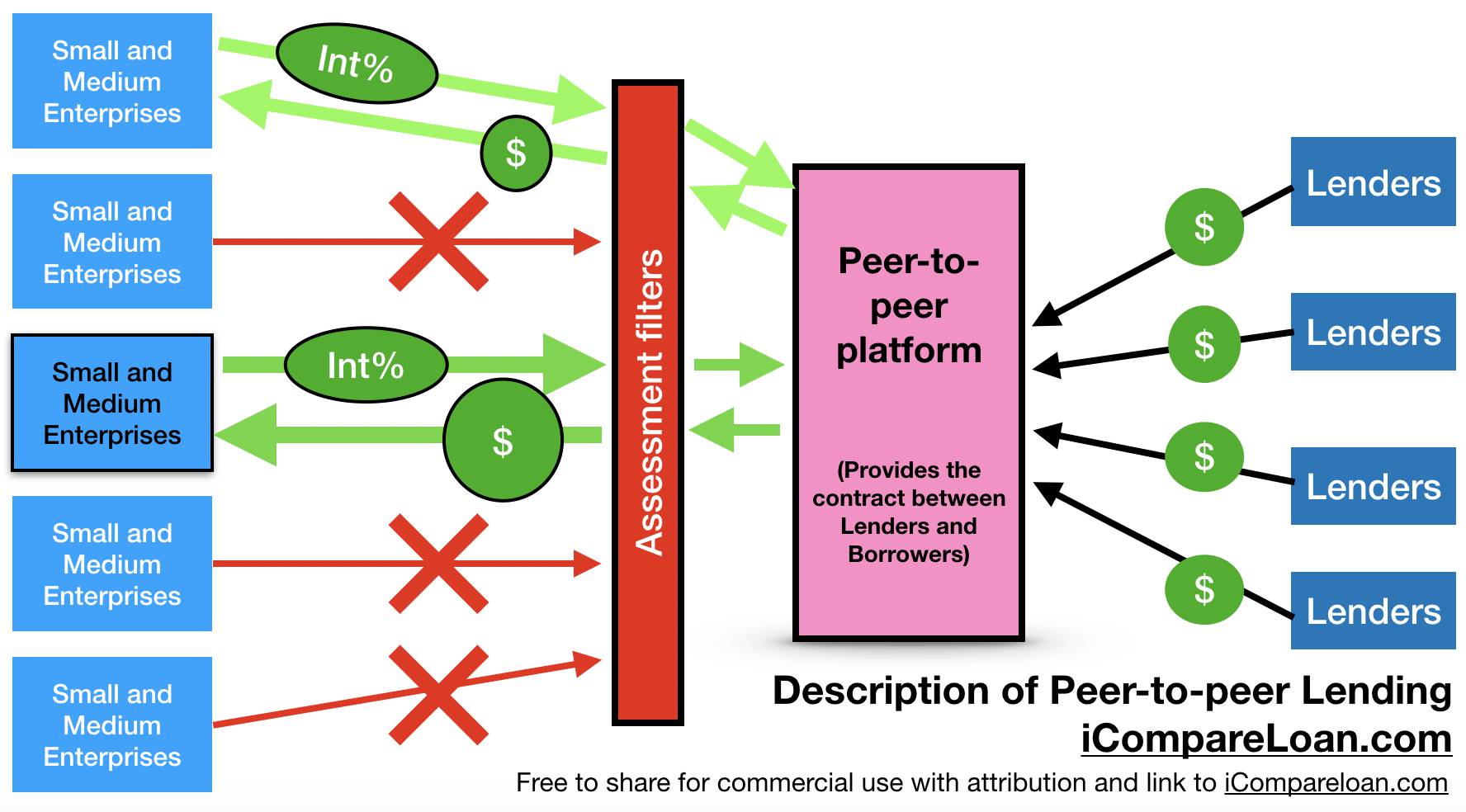

P2p Loan Vs Bridging Loan Things To Know And Differences

What Is A Bridging Loan Money Co Uk

Bridging Loans How Bridging Loans Work Mortgage Choice

Go To Guide For Bridging Loans In Singapore Singsaver

Ultimate Guide To Hmo Bridging Finance 2020 Hmohub

Bridge Loans Guide Is A Bridge Loan Right For You

Don T Miss 6 Ways To Use Bridging Loans Loantube

Bridging Loans Guide

What Are The Pros And Cons Of Bridging Finance Loan Corp

Bridging Loan How Does Bridging Finance Work Bridging Calculator